Last Updated on May 29, 2025

Building a Telecom Financial Model will help you forecast user growth, revenues, operating costs, and infrastructure investments. In this tutorial, I’ll guide you through creating one in Microsoft Excel, from setting up customer growth assumptions to forecasting staffing, operational expenses, and network build costs.

You’ll also learn how to structure a complete cash flow forecast, calculate returns on investment, and stress test the assumptions used in your telecom model.

You can download my Telecom Financial Model Template to follow along. For a complete walkthrough, watch the video tutorial at the end of this post.

Table of Contents

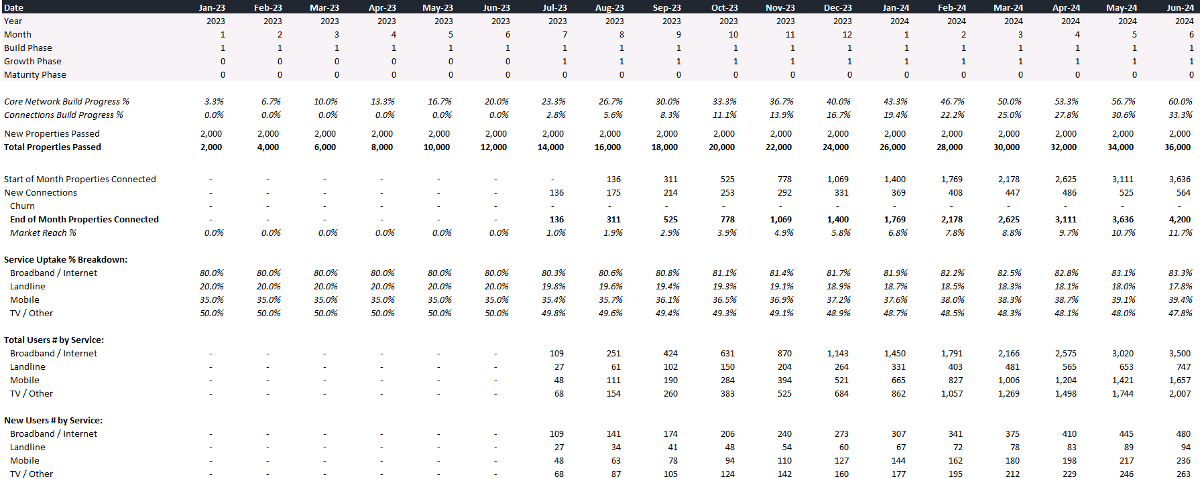

Step 1. Set Up Customer Growth and Telecom Market Assumptions

Begin your Telecom Financial Model by setting up the main financial drivers that will feed into your cash flow forecast. Start by forecasting the number of properties passed—these represent the total addressable market, meaning the units where a telecom company could provide its services.

Next, estimate the number of connected customers by applying a market reach assumption. For example, if your addressable market is 1,000 properties and you assume a 35% reach, you would expect 350 active connections (1,000 × 35%).

Show how these connections phase in overtime to build a dynamic growth forecast. You can also use timeline flags to indicate building and growth periods.

The resulting monthly projections will show how the number of properties passed and connected evolves, becoming the foundation for forecasting user revenue, operating expenses, and network infrastructure costs.

Finally, remember to factor in churn assumptions—the percentage of customers expected to leave over time—for a more realistic user forecast.

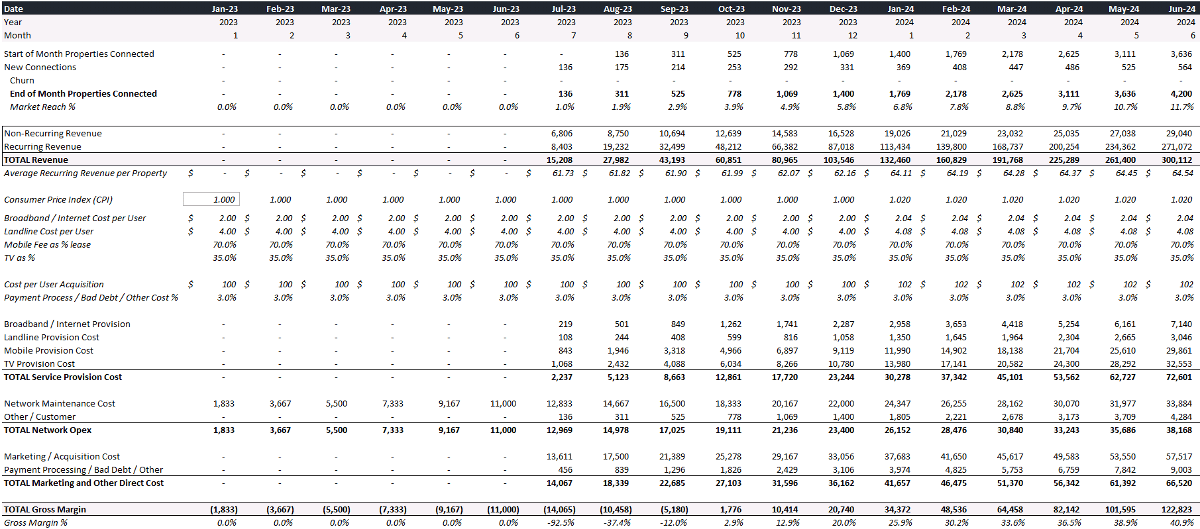

Step 2. Forecast User Revenues by Service Stream

With your customer growth forecast in place, the next step is to project revenues based on service uptake and pricing assumptions. In your telecom model, split revenues into distinct service streams to show how each evolves.

Here are a few examples of modelling telecom revenues:

- Landline — steady income but declining uptake.

- Broadband — increasing usage with low service costs.

- Mobile — with services provided via third-party operators.

- TV / Other — content revenue based on revenue-sharing agreements.

To calculate revenue for each stream, multiply the number of connected users by the expected service uptake percentage and the monthly service fee.

For example, if you have 100 connected users, 80% using broadband, and a $40 monthly fee, your broadband revenue would be $3,200 (100 × 80% × $40).

Over time, adjust your model to reflect pricing changes and shifts in service uptake — both will impact the average revenue per user (ARPU).

Step 3. Forecast Direct Operating Costs by Customer and Revenue Metrics

The next step in your Telecom Financial Model is to forecast direct operating costs — the expenses directly tied to servicing customers. Build these forecasts by linking per-unit cost assumptions to your customer growth projections.

You could break the direct operating costs into three main categories:

- Service Provision Costs — average cost to provide a user with services like mobile or broadband.

- Network Operating Costs — expenses to maintain the telecom infrastructure, often based on homes connected.

- Customer Acquisition Costs — marketing and onboarding expenses tied to the number of new customers.

You can mix different methods to calculate the direct cost.

For example, my Telecom Financial Model Template calculates broadband and landline costs by multiplying the number of connected homes and an average monthly price. In contrast, it calculates mobile and TV costs as a percentage of revenue.

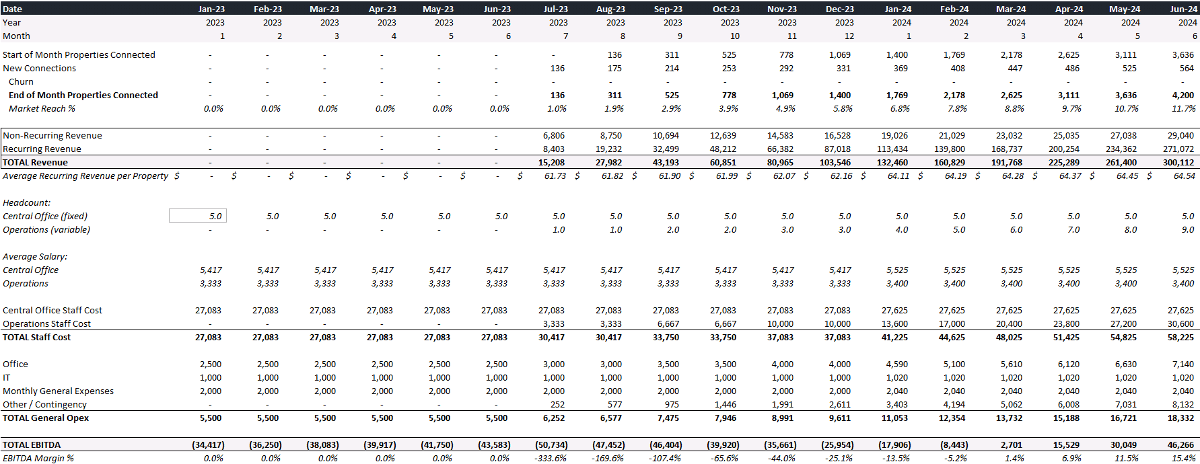

Step 4. Estimate Headcount, Salaries, and Operating Expenses

Accurately forecasting staff costs is essential to building a Telecom Financial Model. Start by separating your headcount forecast into fixed and variable roles, which helps highlight how staffing needs scale with customer growth.

You could break your headcount estimates into:

- Central Headcount — roles like CEO, CFO, and Finance, which are relatively stable regardless of customer numbers,

- Operating Headcount — consisting of customer service and network maintenance teams, whose size grows with the customer base,

- Construction Headcount — the staff required to build the network infrastructure. Depending on the accounting treatment, you could place these costs under CAPEX, not operating expenses.

Multiply each group’s projected number of employees by the average monthly salary to estimate the overall staff cost.

For example, if your customer service team grows to 50 employees with an average monthly salary of $3,000, your projected monthly staffing cost would be $150,000 (50 × $3,000).

Make sure to include inflation assumptions to account for rising salaries over time.

Finally, add central operating expenses like office costs and support services to complete your general operating expense forecast.

👥 For more examples of how staffing needs scale in infrastructure projects, my Capital Investment Plan tutorial shows how to link headcount to growth, project phasing, and average salaries.

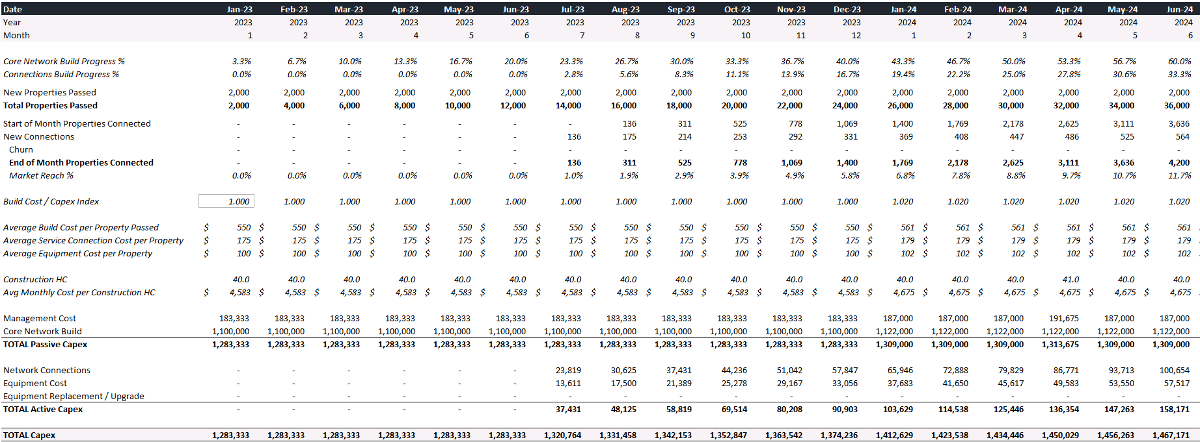

Step 5. Forecast Capital Investment in Network Build and Connections

Capital investment is a significant component of your Telecom Financial Model. Focus on forecasting the cost of building network infrastructure, typically the most substantial part of the project’s upfront expenditure.

You could divide the capital expenditure (CAPEX) into:

- Core Network — the main infrastructure needed to deliver services,

- Network Connections — the cost of linking individual customer properties to the core network,

- Equipment — hardware and devices required to activate customer connections.

Then, calculate the cost of the core network by multiplying the number of newly passed properties by an average build cost per property.

For example, with 1,000 new properties passed and the average build cost of $1,200 per property, your estimated network build cost would be $1.2 million (1,000 × $1,200).

In addition, multiply the number of new customer connections by an average unit cost to forecast spending on network connections and equipment.

Finally, use different depreciation schedules for infrastructure and equipment and options for future upgrades or replacement cycles.

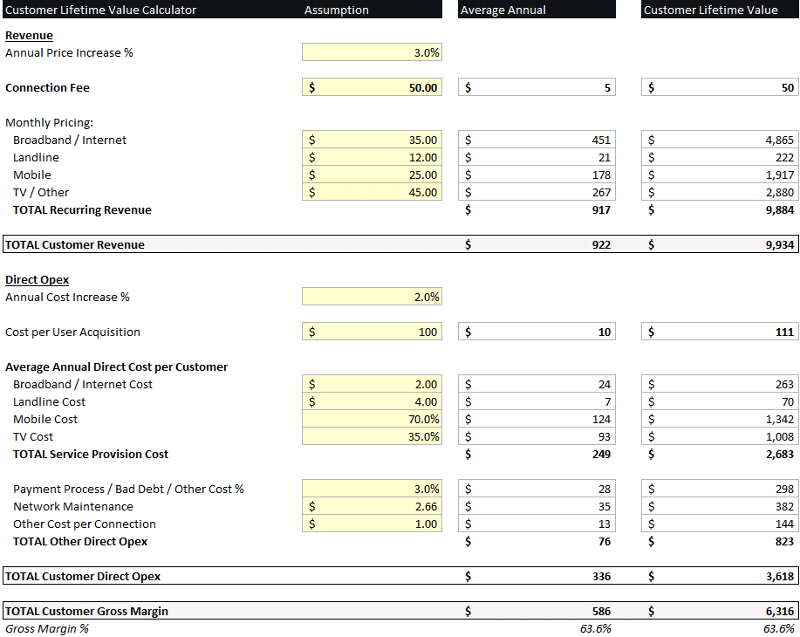

Step 6. Analyze Customer Lifetime Value and Profitability

To better understand your users’ long-term value, calculate the Customer Lifetime Value (CLV) by combining churn assumptions with your revenue and cost forecasts. This analysis also shows how each customer contributes to overall cash flow and return on investment.

You could present the user’s value contribution in one or two following ways:

- Customer Lifetime Calculator and estimates of a customer’s average lifespan based on churn rates, the total revenue and cost contribution per user,

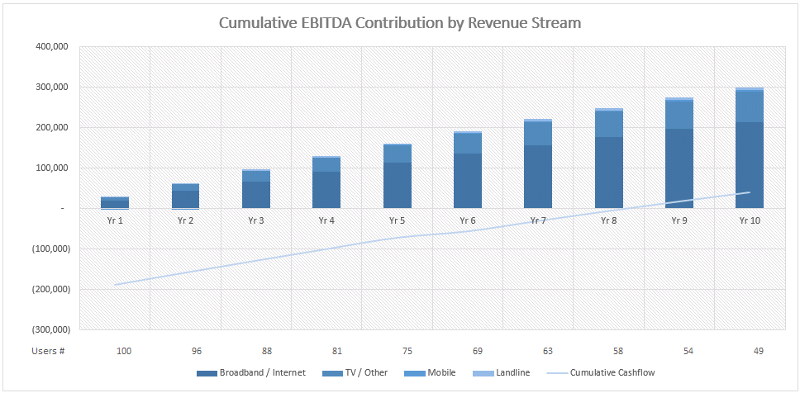

- User Cohort Forecast and a graph showing a group of customers over 10 years and a breakdown of their revenue and costs by service stream.

For example, if your average customer stays active for 5 years, generates $50 of monthly revenue, and incurs $15 in monthly costs, the user’s lifetime contribution would be $2,100 [(($50 – $15) × 12 months) × 5 years].

The User Cohort Forecast below visualizes net revenue contributions over time, showing your telecom investment’s cumulative cash flow, payback period, and breakeven point.

🔄 To explore churn, retention, and lifetime value in more detail, my Subscription Model with Churn Calculation walks through cohort-based forecasts and LTV calculations step by step.

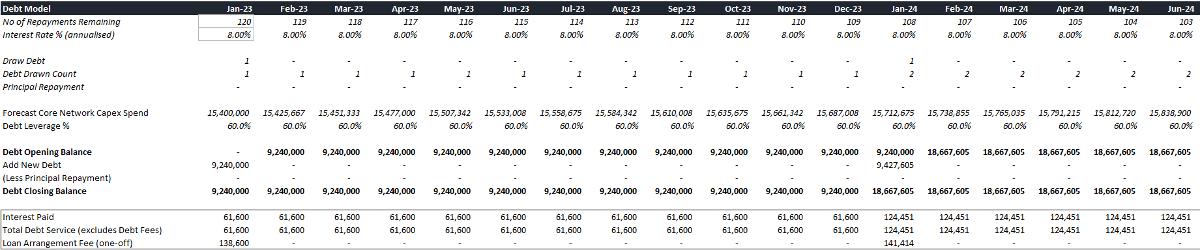

Step 7. Add Debt Financing Based on Capex and Leverage Assumptions

A Telecom Financial Model often requires significant upfront capital, making debt financing a vital part of the cash flow plan. Start by estimating the portion of the investment funded with loans and use the remaining deficit to forecast required equity injections.

My Telecom Financial Model Template links the amount of debt raised to the core network capital expenditure and a debt leverage assumption.

For example, if the forecasted capital investment in a year is $10 million and your leverage assumption is 60%, the model injects $6 million of debt at the beginning of that year (60% × $10 million).

Calculate debt repayment schedules, including assumptions for arrangement fees, interest rates, the number of debt draws, and potential interest-only periods.

Finally, estimate the amount of equity needed to fund the project by looking at the cumulative post-debt cash flow.

💸 If you’re building more complex financing structures, my Financial Model with Debt Financing tutorial explains how to model leverage, repayment terms, and equity top-ups.

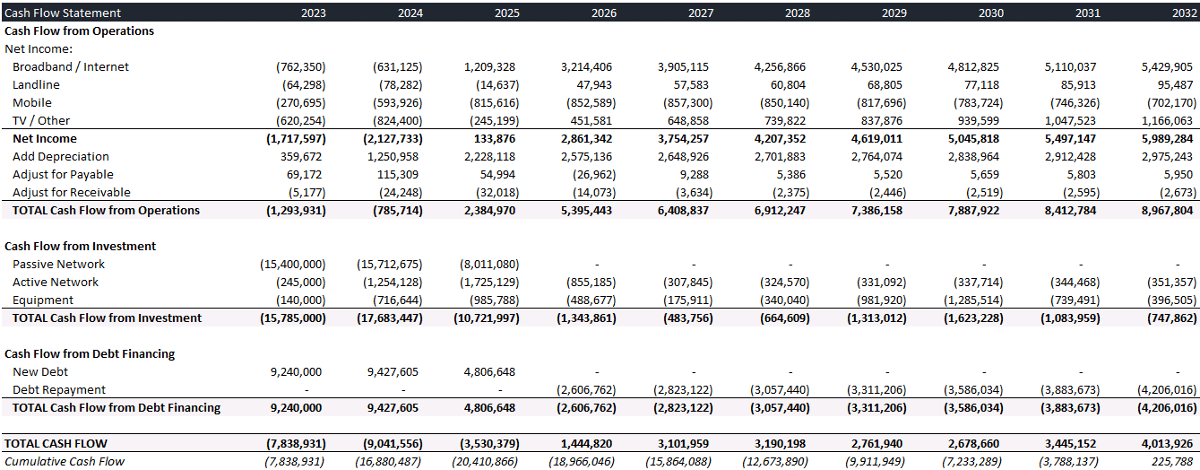

Step 8. Present a Structured Cash Flow Statement

Once you’ve built the detailed cash flow forecast, organize the outputs into a clean, high-level Cash Flow Statement. This summary view makes it easier to spot trends and explain the telecom project’s funding structure.

Group cash flows into three standard categories:

- Operating Activities — recurring revenues and operating expenses from day-to-day business,

- Investment Activities — capital expenditures such as building the core network, connecting customers, and purchasing equipment,

- Financing Activities — debt and equity movements used to fund the investment requirements.

For example, cash generated from customer revenues minus operating expenses flows into Operating Activities, while network build costs appear under Investment Activities.

Finally, link the Cash Flow Statement to the Profit and Loss Statement and Balance Sheet. The complete integration of the spreadsheet ensures that any update to assumptions automatically flows through the entire financial model, keeping everything consistent.

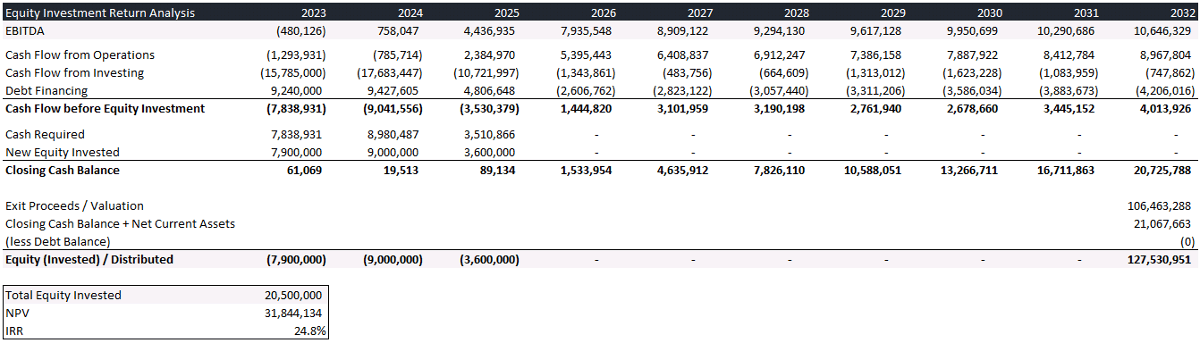

Step 9. Calculate ROI, IRR, and Terminal Value

Once the telecom cash flow forecast is complete, the next step is calculating the Return on Investment (ROI). Start by estimating the level of equity required based on any cash deficits that remain after debt financing.

My Telecom Financial Model Template uses an EBITDA multiplier as one of the methods to estimate the terminal value.

For example, if the project’s EBITDA at exit is $1 million and the assumed multiplier is 10×, the terminal value would be $10 million ($1 million × 10).

To forecast the necessary equity injections, add the cash flows from operating and investing activities and offset them with debt financing. Any remaining annual deficit represents the additional equity requirement.

Calculate the internal rate of return and the investment’s net present value using Microsoft Excel’s built-in IRR and NPV formulas.

Finally, round out your ROI analysis by calculating the cash flow breakeven month (when the project becomes cash positive) and the equity payback period (how long it takes for an investor to recover their capital).

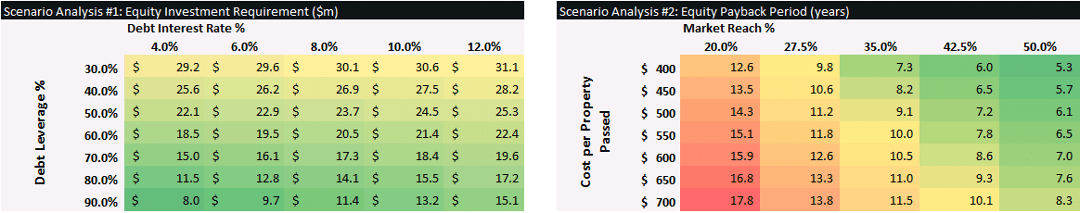

Step 10. Stress Test the Model with Sensitivity Analysis

A final step in building a Telecom Financial Model is stress testing the assumptions. Set up an explicit assumptions table near your annual cash flow summary to easily see how changing inputs affect key outputs like ROI and payback periods.

Since telecom projects rely heavily on upfront capital investment and long-term customer revenue, the model’s results are sensitive to changes in construction costs, pricing, churn, and other critical factors.

For example, you can test how changing the debt interest rate or leverage ratio impacts the required equity investment or how shifting market reach and build costs affect the equity payback period.

Use Microsoft Excel’s data tables to produce the output of the sensitivity analyses.

Compare metrics such as margins against telecom industry benchmarks to ensure the model remains realistic [external link].

📌 Recap: 10 Steps to Build a Telecom Financial Model

Here’s a quick recap of the steps we covered to build a complete Telecom Financial Model:

- Forecast Customer Growth. Phase the number of passed and connected properties over time.

- Project Telecom Revenues. Link service streams to customer growth and pricing assumptions.

- Calculate Direct Operating Costs. Forecast costs based on per-unit values or revenue shares.

- Estimate Headcount and Salaries. Tie staffing needs to the business growth and apply salary assumptions.

- Forecast Capital Investment. Model network build costs, customer connections, and equipment spending.

- Analyze Customer Lifetime Value. Calculate profitability per user and track cohorts over time.

- Add Debt Financing. Optimize the capital structure by injecting debt and modelling repayments.

- Present Cash Flow Statement. Organize financials into operating, investing, and financing sections.

- Calculate Returns on Investment. Estimate IRR, NPV, equity injections, and terminal value.

- Stress Test Assumptions. Analyze how changing key inputs impacts financial outcomes.

Following these steps, you’ll build a dynamic telecom cash flow forecast ready for real-world investment analysis.

📥 Download My Telecom Financial Model Template

This is the full Excel model featured in the tutorial—pre-built to forecast customer growth, revenues, staffing, capex, and returns. It’s fully integrated and automated, so you can focus on refining assumptions, not building from scratch.

This spreadsheet includes everything you need to build a telecom investment model, including:

- Monthly Cash Flow Forecast — detailed revenue and service stream cost projections.

- Passed and Connected Properties — fully phased market growth assumptions.

- Headcount and Salary Forecasts — linking staffing needs to customer growth.

- Capital Investment Planning — forecasting network build, customer connections, and equipment spending.

- Profit & Loss, Cash Flow, and Balance Sheet — integrated annual financial statements.

- Equity and Terminal Value Calculations — including full ROI metrics.

- Customer Lifetime Value and Cohort Analysis — detailed profitability tracking.

✔️30-Day Money Back Guarantee included

Video Tutorial on Building a Telecom Financial Model

You can follow along step-by-step with my complete video tutorial, where I explain how to create and customize a Telecom Financial Model using Microsoft Excel. In the video, I cover:

- How to forecast passed properties, market reach, and customer growth.

- How to project telecom revenues by service stream and calculate direct operating costs.

- How to build Profit and Loss, Cash Flow, and Balance Sheet statements.

- How to calculate returns on investment and perform stress tests on key assumptions.

By the end of the tutorial, you’ll know exactly how to use my Telecom Financial Model Template to build dynamic forecasts and analyze financial outcomes.

Get in Touch

Hi, I’m Jacek. I’m passionate about spreadsheets and financial models! I hope you found this tutorial helpful and that it gave you a strong foundation for building your Telecom Financial Model.

Hi, I’m Jacek. I’m passionate about spreadsheets and financial models! I hope you found this tutorial helpful and that it gave you a strong foundation for building your Telecom Financial Model.

Feel free to reach out if you have any questions about financial modelling, forecasting, or Excel techniques.

You can also explore my other tutorials for more hands-on guides or check out my One-to-One Training and Financial Modelling Services if you need personalized support.

Disclaimer: This tutorial is for informational and educational purposes only and should not be considered professional advice.

Explore More Financial Modeling Tutorials

Want to dive deeper into financial modelling? Here are more tutorials you might find helpful:

- How to Create a Capital Investment Plan — Refine your approach to phasing and ROI for network infrastructure investments, enhancing your telecom capex schedules.

- How to Build a Cash Flow Forecast in Microsoft Excel — Learn how to create a full customer-driven forecast, including discounted cash flow (DCF) valuation.

- Subscription Model with Churn Calculation — Estimate customer growth, churn, lifetime value, and revenue forecasts for subscription businesses.

- How to Analyze Data in Microsoft Excel with Power Query and Pivot Tables — Automate data cleansing and build dynamic dashboards for your telecom inputs.

- How to Use Cohort Analysis to Calculate Retention and Churn Rate in Excel — Deepen your understanding of user-level profitability metrics critical to calculating telecom ARPU and churn.